TOP GAINERS GPT

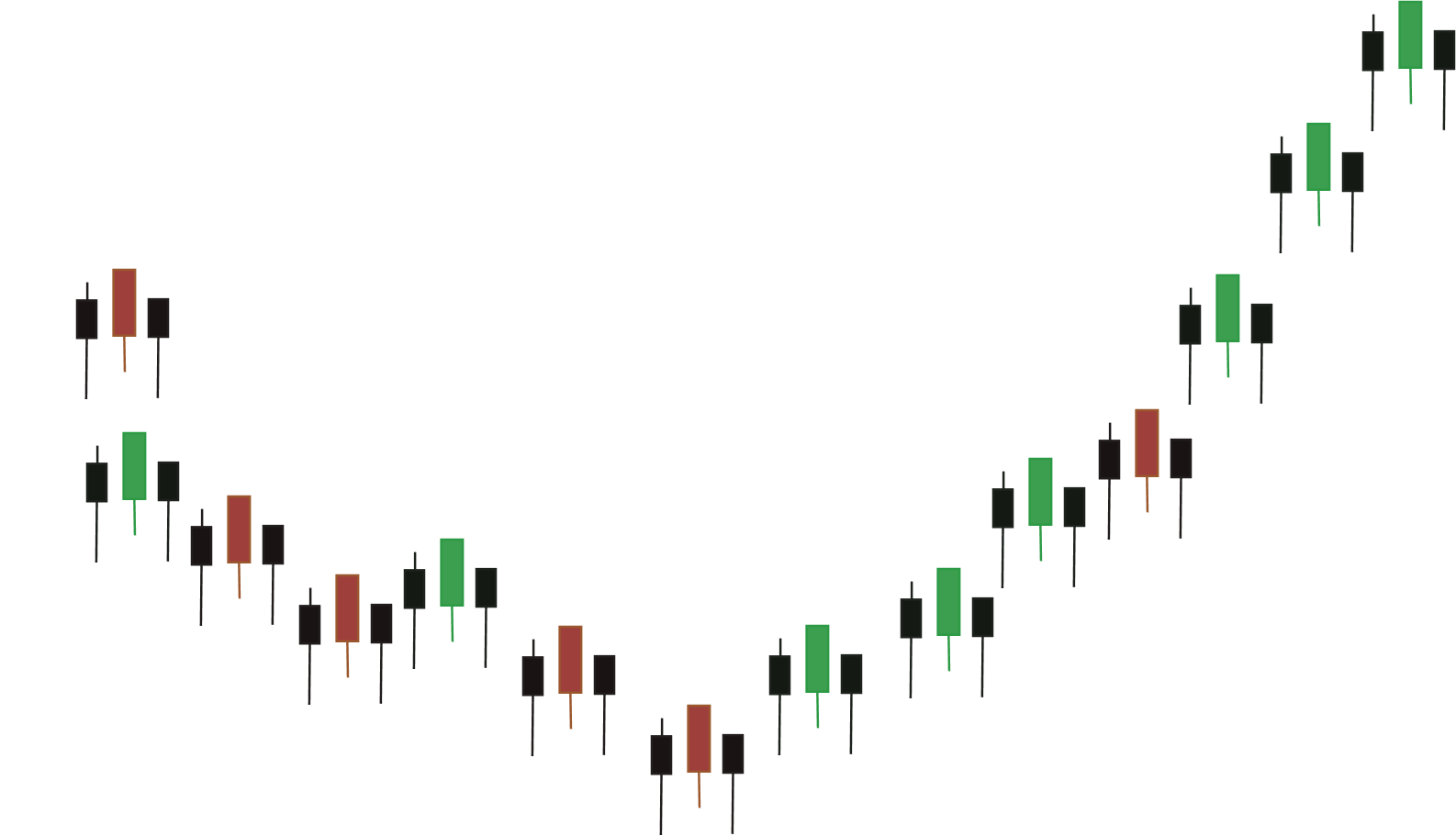

AI that monitors NSE’s top gainers and explains what’s driving the market—daily!!

FAQs

What is Top Gainers GPT?

Top Gainers GPT is an AI-based analytics tool that interprets daily top gainers on India’s NSE. It provides institutional-grade insights using GPT-4 Turbo to decode why a stock is outperforming.

How does the AI generate insights?

Top Gainers GPT leverages transformer-based NLP architecture (GPT-4 Turbo) fine-tuned for financial inference. It parses structured and unstructured data—integrating institutional order flow patterns, bulk transaction anomalies, and quantified sentiment deltas—to construct a probabilistic explanation layer over observed price action.

What qualifies as a 'top gainer'?

Stocks with the highest percentage price appreciation on the NSE during the trading day, typically with meaningful volume and liquidity, are evaluated as potential top gainers.

What do the insight categories mean?

- Institutional Interest: Indicates significant buying activity by institutions.

- Bulk Deals: Suggests large-volume trades, typically signaling accumulation.

- Market Sentiment: Gauges investor tone using news and behavioral signals.

Is this tool predictive or explanatory?

Top Gainers GPT is primarily explanatory, decoding market moves based on historical and intra-day signals. A multibagger prediction module is in development.

Is this a trading or investment advisory?

No. This tool provides AI-driven market intelligence, not investment advice. Users should independently verify any insights before acting on them.

How frequently is the data updated?

Insights are refreshed daily post-market with data from NSE, proprietary sources, and real-time feed analysis.

Who is this designed for?

The platform is built for retail investors, analysts, and institutions seeking immediate context behind market momentum without parsing dense data.